Small Business Fraud Prevention Internal Control Workbook

$35.00

The Vitalics Small Business Fraud Prevention and Internal Control Workbook

Individual Download

- Description

- Reviews (0)

- Table of Contents

Description

This Vitalics Small Business Fraud Prevention and Internal Control Workbook was created to outline a simple system of internal controls that can be implemented within smaller organizations in order to prevent fraud in small business. It is important for both the business owner and management to set up and follow a simple to use internal control procedure to help reduce fraud risks. It is also important for employees to use the internal control system to protect their work in case they are falsely accused of fraud or asset misappropriation.

If you are a smaller organization that has limited staff”i.e., one bookkeeper handling all accounting functions, then you, the business owner, are the missing link in the segregation of duties. When an organization has missing internal controls, no segregation of duties, and/or a bookkeeper or employee with too much accounting authority who can take advantage of the weakness within a small business, the owner and/or authorized official must review, sign off on, and understand their books.

The Vitalics Small Business Fraud Prevention and Internal Control Workbook is the perfect tool to help you understand the inherent fraud risks, occupational fraud schemes, and prevention measures to protect your organization. Vitalics is dedicated to smaller organizations and is fighting to prevent fraud in small business by providing the tools necessary to stop fraud before it starts. The first stepping stone is to understand occupational fraud as it relates to smaller organizations. The small business fraud prevention and internal control workbook is the solution your business is looking for.

Be the first to review “Small Business Fraud Prevention Internal Control Workbook”

- Fraud Statistics

- The Fraud Triangle

- Workplace Conditions

- Behavioral Warning Signs

- Occupational Fraud

- Billing Schemes

- Check Tampering Schemes

- Bribery and Corruption

- Skimming

- Expense Reimbursement Schemes

- Cash on Hand Schemes

- Cash Larceny Schemes

- Non-Cash Schemes

- Payroll Fraud Schemes

- Fraudulent Financial Statements

- Register Disbursements

- Internal Control Procedures

- Using Ratios to Prevent and Detect Fraud

- The Difference Between Bad Bookkeeping and Fraud

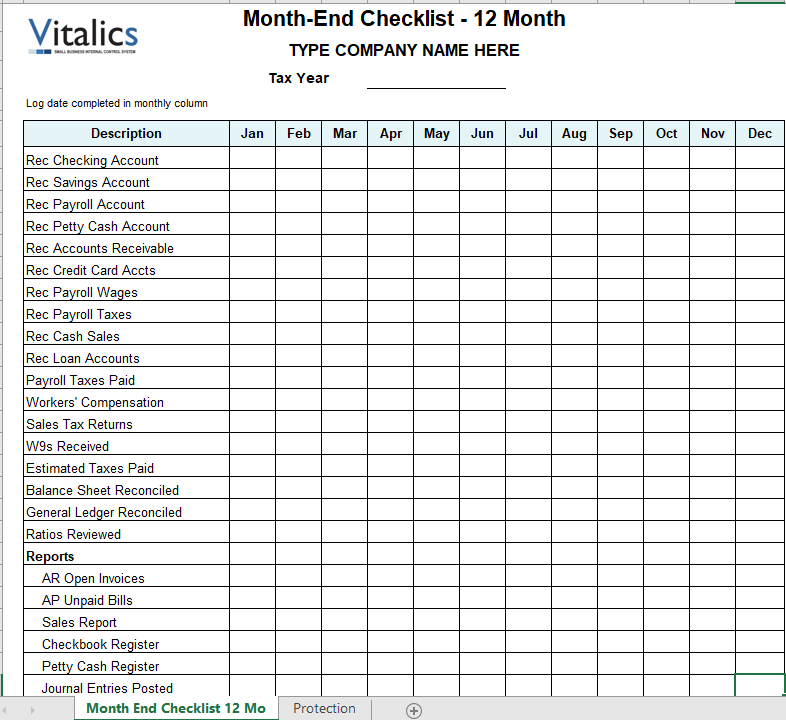

- Fraud Prevention Maintenance

- Glossary

- Index

Reviews

There are no reviews yet.